Facing an onslaught of demands on its cash amid a stock marketplace frenzy, Robinhood, the on line trading application, explained on Thursday that it was raising an infusion of additional than $1 billion from its existing traders.

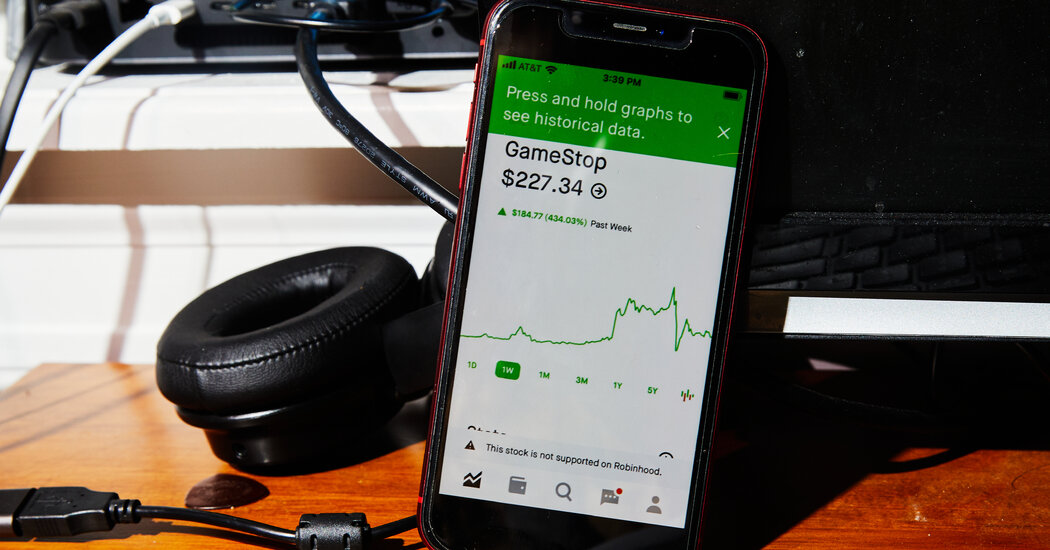

Robinhood, one of the major on the internet brokerages, has grappled with an terribly significant volume of trading this 7 days as individual investors have piled into shares like GameStop. That exercise has place a strain on Robinhood, which has to spend buyers who are owed funds from trades when publishing more income to its clearing facility to insulate its trading associates from opportunity losses.

On Thursday, Robinhood was pressured to stop customers from purchasing a number of stocks like GameStop that have been closely traded this week. To keep on running, it drew on a line of credit from 6 financial institutions amounting to in between $500 million and $600 million to meet up with increased margin, or lending, necessities from its central clearing facility for stock trades, known as the Depository Believe in & Clearing Corporation.

Robinhood nevertheless essential additional dollars speedily to assure that it didn’t have to area additional boundaries on buyer buying and selling, mentioned two people briefed on the scenario who insisted on remaining anonymous for the reason that the negotiations were confidential.

Robinhood, which is privately held, contacted several of its investors, which include the venture money corporations Sequoia Capital and Ribbit Capital, who came alongside one another on Thursday night to give the crisis funding, 5 people included in the negotiations explained.

“This is a strong indicator of confidence from traders that will assist us keep on to additional serve our shoppers,” Josh Drobnyk, a Robinhood spokesman, mentioned in an e-mail. Sequoia and Ribbit declined to comment.

Traders who present new funding to Robinhood will receive additional equity in the enterprise. The traders will get that fairness at a discounted valuation tied to the cost of Robinhood shares when the enterprise goes general public, reported two of the folks. Robinhood strategies to keep an preliminary general public providing later this year, two people briefed on the designs reported.

Robinhood’s crisis fund-raising is the latest signal of how trading in the stock current market has been upended this 7 days.

An online army of buyers, who have been on a mission to challenge the dominance of Wall Street, fast bid up the rate of shares like GameStop, entrapping the large-revenue hedge funds that experienced guess versus the shares. Some of these personal buyers have reaped substantial earnings, when at least a person important hedge fund experienced to be bailed out soon after facing enormous losses.

Robinhood, which is based in Silicon Valley, has been crucial to empowering the on line traders. Adoption of the application has soared in the pandemic as the inventory industry surged and people took up working day buying and selling in the void of other pastimes. The corporation has drawn in thousands and thousands of youthful buyers who have under no circumstances traded ahead of by supplying no-rate trading and an app that critics have reported tends to make obtaining stocks come to feel like an on the net sport.

Without charges, Robinhood would make income by passing its shopper trades along to bigger brokerage corporations, like Citadel, who fork out Robinhood for the possibility to satisfy its customer inventory orders.

In May possibly, Robinhood explained it experienced 13 million people. This week, it became the most-downloaded free of charge app in Apple’s Application Retail store, in accordance to Apptopia, a info service provider.

Critics have accused the firm of encouraging people today to gamble on stock industry movements and hazard huge losses. Brokerages including T. Rowe Selling price, Schwab and Fidelity have imitated Robinhood by decreasing their investing costs to zero. Quite a few of them ended up also strike by the crush of buying and selling this week.

Robinhood has had no problems increasing income around the past year, drawing $1.3 billion in venture money backing and boosting its valuation to nearly $12 billion. Its other investors include things like the venture funds organization DST Funds, New Business Associates, Index Ventures and Andreessen Horowitz.

Yet the corporation has faced many challenges, such as fines from regulators for deceptive buyers. Past March, it lifted more dollars following its app went down and left buyers stranded and nursing large losses, main to a nonetheless ongoing lawsuit.

In modern months, numerous on line investors have utilised Robinhood to make bets that pushed up the price tag of GameStop, AMC Amusement and other stocks that experienced been greatly shorted — or wager towards — by hedge money. That improved on Thursday immediately after the corporation curbed client buying and selling in the most popular stocks.

“As a brokerage agency, we have several economic demands,” Robinhood claimed in a web site write-up Thursday. “Some of these specifications fluctuate based on volatility in the marketplaces and can be substantial in the present-day environment.”

In protest, hundreds of countless numbers of customers joined a campaign to give Robinhood’s application the most affordable just one-star evaluation and generate the company’s score down. Some traders also sued Robinhood for the losses they sustained just after the business slash off trading in particular shares and many lawmakers urged regulators to training extra scrutiny of the company.